Spreading Financial Statements to Improve Analyst Workflow

Is your finance team spending too much time manually extracting and formatting data from financial statements? As the volume of financial disclosures increases, analyst workloads have become more complex. Traditional methods often involve repetitive, manual tasks that delay analysis and affect productivity.

Is your finance team spending too much time manually extracting and formatting data from financial statements? As the volume of financial disclosures increases, analyst workloads have become more complex. Traditional methods often involve repetitive, manual tasks that delay analysis and affect productivity.

This blog explores how optimizing and automating the process of spreading financial statements improves analyst workflow. It covers intelligent extraction, statement reconciliation, multilingual support, and standardization to help finance teams work more accurately and quickly.

Manual Challenges in Financial Data Preparation

Finance professionals are responsible for turning raw financial data into insights that drive decisions. Before any analysis can begin, analysts must extract, structure, and reconcile data from various formats, including PDFs, spreadsheets, and scanned reports.

Manual spreading financial statements requires meticulous attention to detail. Analysts often spend hours reformatting figures, cross-checking totals, and confirming that income statements, balance sheets, and cash flow statements align correctly. This time-consuming process slows productivity and increases the risk of human error.

Intelligent Automation Saves Time and Reduces Errors

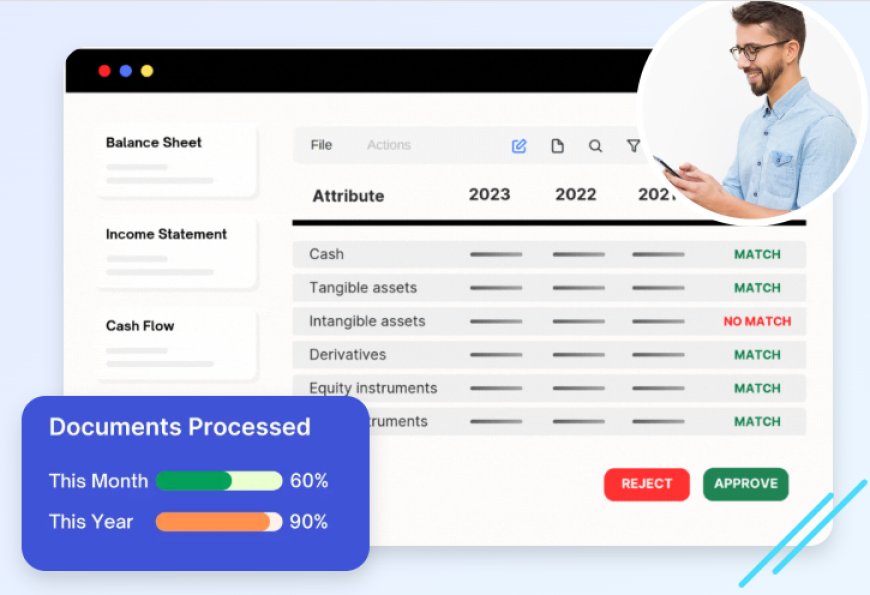

Automated solutions use machine learning and natural language processing to extract data with high accuracy. These systems can interpret structured, semi-structured, and scanned financial documents across various formats.

By automating spreading financial statements, analysts can eliminate many manual steps. Data is extracted quickly, mapped into standard formats, and prepared for analysis in a fraction of the time it would take using traditional methods. This allows teams to move faster without sacrificing accuracy.

Achieving Accurate Reconciliation Across Reports

Reconciling figures across different financial reports is a significant challenge in financial analysis. Values in the balance sheet must align with those in the cash flow statement and income report. Discrepancies can distort analysis and delay critical decisions.

Automated spreading financial statements tools apply built-in checks that validate totals across statements. These systems flag inconsistencies and help users resolve them quickly. As a result, the reconciled data is more reliable, and analysts can work with greater confidence.

Consistent Formats Enable Comparative Analysis

Every financial document has its layout, structure, and terminology. Comparing one companys results to anothers can be misleading without standardization. Analysts must first align the formats before they can compare financial performance accurately.

Automated tools standardize the output of spreading financial statements into clean, comparable templates. This makes evaluating year-over-year performance, benchmarking against peers, and conducting scenario modeling easier without spending hours on data prep.

Multilingual and Complex Document Handling

Global finance teams often deal with documents in multiple languages, formats, and layouts. Traditional tools struggle to accurately extract data from non-English documents or those with nested tables and unusual formatting.

Advanced systems support multilingual extraction and can process complex layouts without translation or reformatting. These tools simplify the spread of financial statements from international subsidiaries or partners. Analysts can focus on analysis rather than worrying about interpretation or data accuracy.

More Time for Analysis and Strategy

When analysts are not bogged down by data extraction, they can dedicate more time to strategic activities like forecasting, modeling, and performance review. Automating the spread of financial statements helps shift the analysts role from data preparer to decision support expert.

With faster access to ready-to-analyze data, teams can respond more quickly to business needs. This improves collaboration and shortens decision-making cycles across departments and regions.

Scalable Solutions for Growing Workloads

Finance teams in banks, investment firms, and corporations are handling more data than ever before. Processing hundreds or thousands of statements manually is no longer practical. Scalability is essential for organizations that need to maintain speed as volumes grow.

Modern systems for spreading financial statements support bulk processing, enabling teams to manage high workloads efficiently. They integrate with enterprise data platforms and ensure all teams work from a consistent, centralized source of truth.

Improving Auditability and Compliance

Regulatory compliance and audit readiness are key priorities for financial operations. Manually entered data can be difficult to trace, especially if source files are missing or changed after entry. This exposes teams to compliance risks and delays during audits.

Automated systems maintain detailed audit trails for every entry and adjustment. Users can trace every value back to its original source document when spreading financial statements. This improves transparency, simplifies review processes, and ensures internal and external standards compliance.

Conclusion

The finance industry is moving toward smarter, faster, and more reliable analysis. Manually spreading financial data from statements is no longer sustainable for teams facing growing volumes and tight deadlines. Automation provides a smarter way to manage data and improve outcomes.

By automating spreading financial statements, organizations unlock efficiency, reduce error rates, and empower analysts to work more strategically. Analysts can spend less time cleaning and preparing data and more time interpreting trends, evaluating risk, and advising stakeholders.

The right technology ensures consistency, scalability, and auditability. It also prepares finance teams for growth by giving them tools to handle complex, high-volume financial data more easily. Automating this key step is a strategic move for any organization focused on enhancing decision quality and operational efficiency.