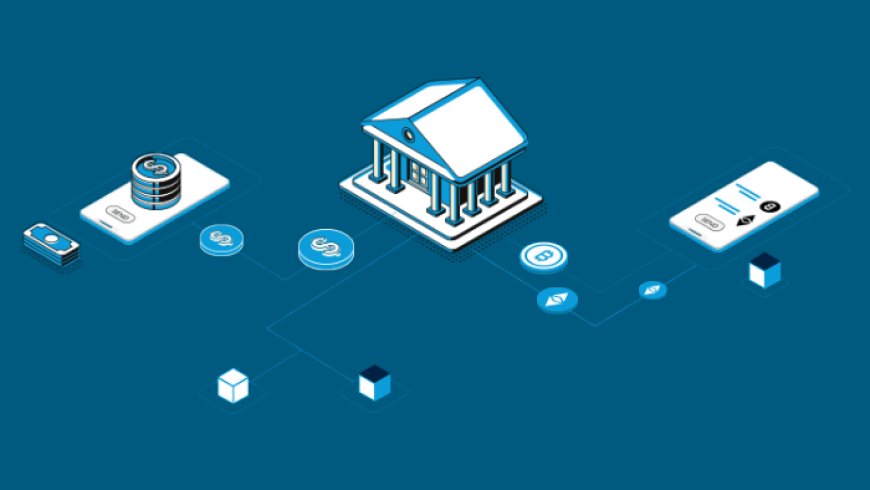

Web3 Banking: The Next Big Shift in the Financial Industry

Using blockchain reduces costs. Sending money through aweb3 bankplatform can be almost instant and often cheaper than traditional bank wires. Plus, you get real-time confirmation of your transfers.

Innovative Financial Products

Web3 introduces new ways to grow your money. You can participate in yield farming, staking, or decentralized loans. Smart contracts let you customize services exactly how you want. Its like having your own bank tailored to your needs.

Improved Transparency and Trust

Because transactions are on a public ledger, you can always verify whats happening. This makes trust easier, especially when dealing with strangers or unknown services. Real-world examples, like DeFi platforms, show how transparency builds confidence.

Challenges and Limitations

Still, Web3 isnt perfect. Laws around crypto are unclear in many regions. Also, scalability issues can slow down transactions. Some platforms still have confusing user interfaces, making it hard for beginners to get started.

Regulatory Landscape and Future Outlook

Current Regulations Affecting Web3 Banks

Governments around the world are working to set rules for crypto and Web3 services. Some countries embrace the change, others tighten restrictions. Banks and startups alike must follow new compliance rules or face fines.

Opportunities and Risks for Traditional Banks

Traditional banks could partner with Web3 firms or adopt new tech themselves. But many see Web3 as a serious threat. They may need to rethink how they serve customers in this digital world.

Future Trends in Web3 Banking

Expect more automation with AI, Internet of Things (IoT), and smarter security. The global Web3 finance market could grow rapidly, with some analysts predicting billion-dollar valuations in the next few years. Innovation will only accelerate.

Actionable Tips for Stakeholders

For entrepreneurs: focus on building trust and understanding regulations.

For consumers: learn about the risks but dont ignore the benefits.

For regulators: find ways to protect users while encouraging innovation.

Conclusion

web3 bankare set to change the way we bank online by putting control back into users hands. They make transactions faster, safer, and more accessible than ever before. As this technology grows, staying informed and prepared will be key. The future of banking isnt just digital its decentralized and open for everyone.

Discover More At:-

Follow Us On LinkedIn:-https://www.linkedin.com/company/digital-era-bank

Follow Us On Twitter:-https://x.com/digitalerabank

Follow Us On Telegram:-https://t.me/debctokens

Follow Us On Discord:-https://discord.gg/Ez5g6dHeB5

Follow Us On Medium:-https://medium.com/@digitalerabank

Follow Us On Reddit:-https://www.reddit.com/r/DigitalEraBank/

Address:- Intershore Chambers, Road Town, Tortola, British Virgin Islands

Email Us:- investor.relations@digitalerabank.com

Call Us :- +1 (604) 800-0932